New year, new contribution limits!

The IRS has announced the new 2025 contributions limits.

These limits are extremely important to ensure your plan is compliant with IRS regulations.

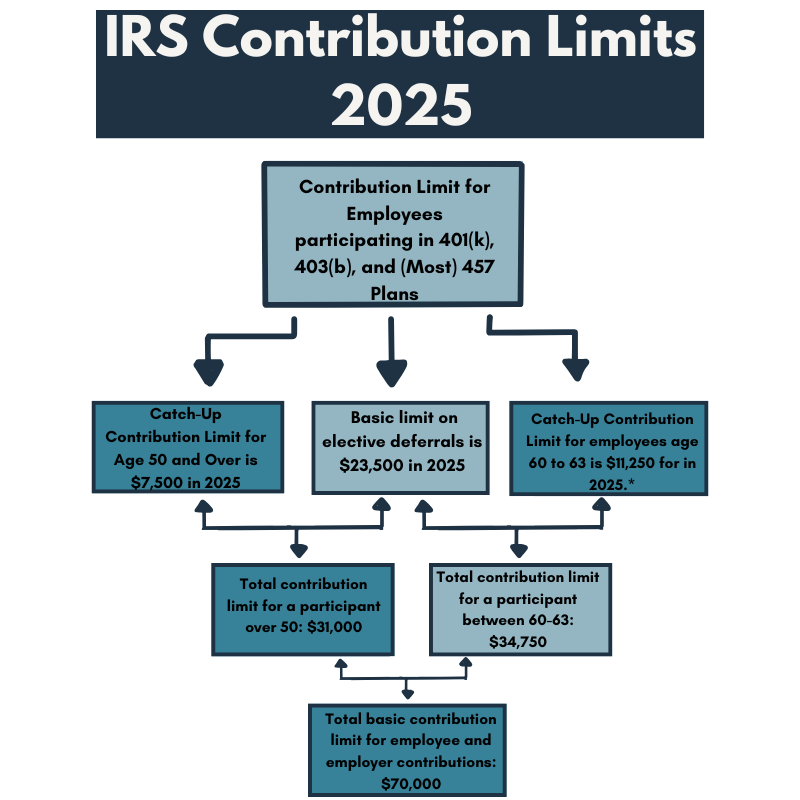

The employee contribution limits for employees participating in 401(k), 403(b), and most 457 plans will be increasing to $23,500 in 2024. The catch-up contribution limit, which is only available for participants over the age of 50, will be $7,500 in 2025. If your plan currently allows for the age 50 catch-up provision (only applicable if your plan is administered by ADMIN Partners), it will also now include an additional “super” catch up contribution limit for employees aged 60 to 63 and the limit for this will be $11,250 for 2025. The employee contribution limit total for a participant over the age of 50 is, $31,000. The total contribution limit for employee and employer contributions is $70,000.

For more information click below for the IRS announcement.

Stay connected with us for more ADMIN Partners news and industry information! Follow us @adminpartners on all social media platforms.

Happy New Year from the entire ADMIN Partners team!