The IRS has released the a lot of new information for the upcoming year. This week we take a look at the new contribution limits and compare them to last year. These limits are extremely important to ensure your plan is compliant with IRS regulations.

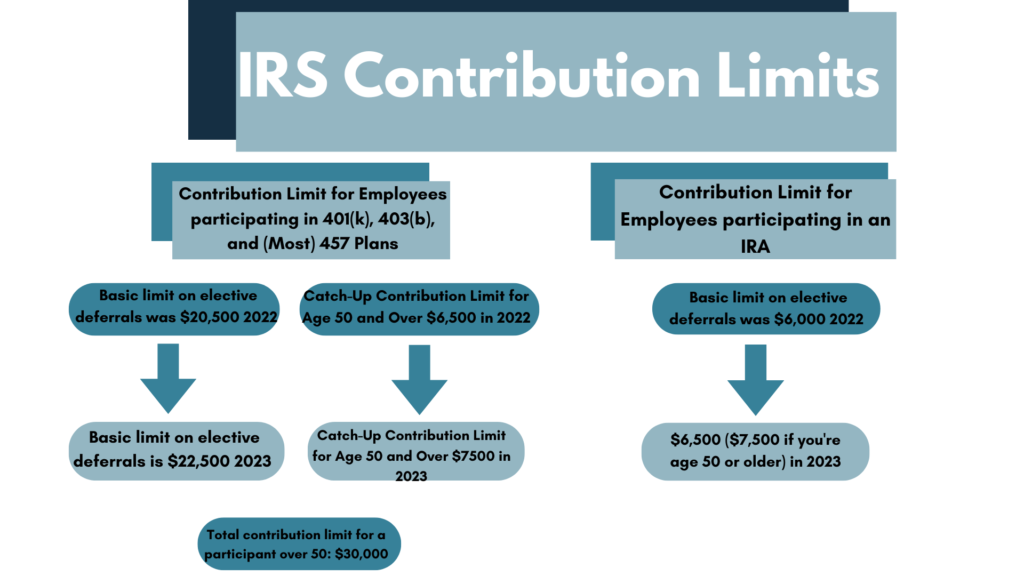

The contribution limits for employees participating in 401(k), 403(b), and most 457 plans is increasing from $20,500 in 2022 to $22,500 in 2023. The catch-up contribution limit, which is only available for participants over the age of 50, is increasing from $6,500 in 2022 to $7,500 in 2023. The contribution limit total for a participant over the age of 50 is, $30,000. Participants contributing to an IRA are now able to contribute, $6,500 or $7,500 if over the age of 50 in 2023 compared to the basic limit on elective deferral of $6000 in 2022. The increase in the limits is reflective of the current economic situation and rising inflation.

Click the picture below for the direct link to the IRS website for more information on contributions!

Stay connected with us for more ADMIN Partners news and industry information! Follow us @adminpartners on all social media platforms. If you have any questions please feel free to use our Contact Us form or reach out to us via email at contact@youradminpartners.com