Retirement financial planning has always been extremely important, but with the increasing inflation it is even more important to increase your savings for retirement. Preparing for retirement can be really overwhelming, but both auto-enrollment and auto-escalation are potential solutions to help participants save more for retirement. Auto-enrollment and auto-escalation in retirement plans is a popular topic of conversation and many states and organizations have implemented some variation of either or both. In fact, the proposed Secure Act 2.0 has a provision that would apply to new 401(k) and 403(b) plans which would include both auto enrollment and auto escalation.

What is Automatic Enrollment?

Auto-enrollment will automatically enroll qualifying employees into their offered employer retirement program. There is an option for a participant to elect out of the plan if they wish to do so. Under Secure Act 2.0 there will be exceptions to the provision, like small businesses with 10 or less employees.

What is Automatic Escalation?

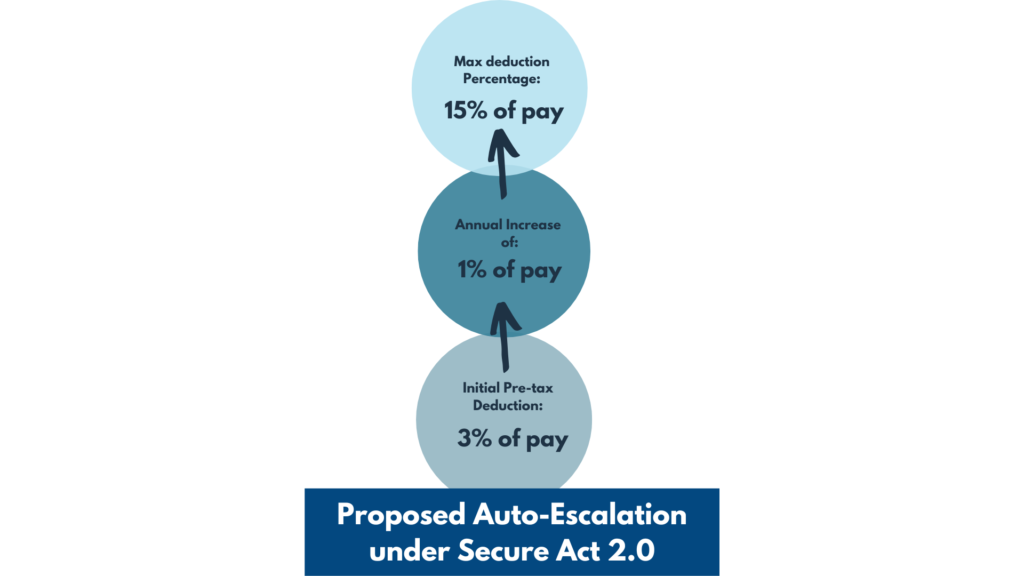

A solution to increase your retirement deduction year by year is automatic escalation. As the name suggests it is the automatic increase in deduction percentage, typically on a yearly basis. This will allow your savings to increase without having to remember each year to reach out to your payroll personnel to increase your deduction. Under the proposed Secure Act 2.0, the initial starting contribution at a pre-tax level would be 3% of the participant’s pay. It would then increase annually by 1% percentage point with a 15% cap.

Both auto-enrollment and auto-escalation are meant to encourage people to actively save more for retirement. Follow us for more education on different retirement plan topics in our (b)informed series! If you have any questions or comments please reach out to us via our email [email protected] or our social media accounts @youradminpartners.