Employers have enough on their plates when it comes to daily operations. Administering retirement plans should not be one of them. With retirement policy changes over the last few years, it makes it even more difficult ensure these plans are operating in a compliant manner with the IRS and DOL. Additionally over the last few years, the IRS penalties have dramatically increased for plan sponsors making it even more vital for plans to be compliant.

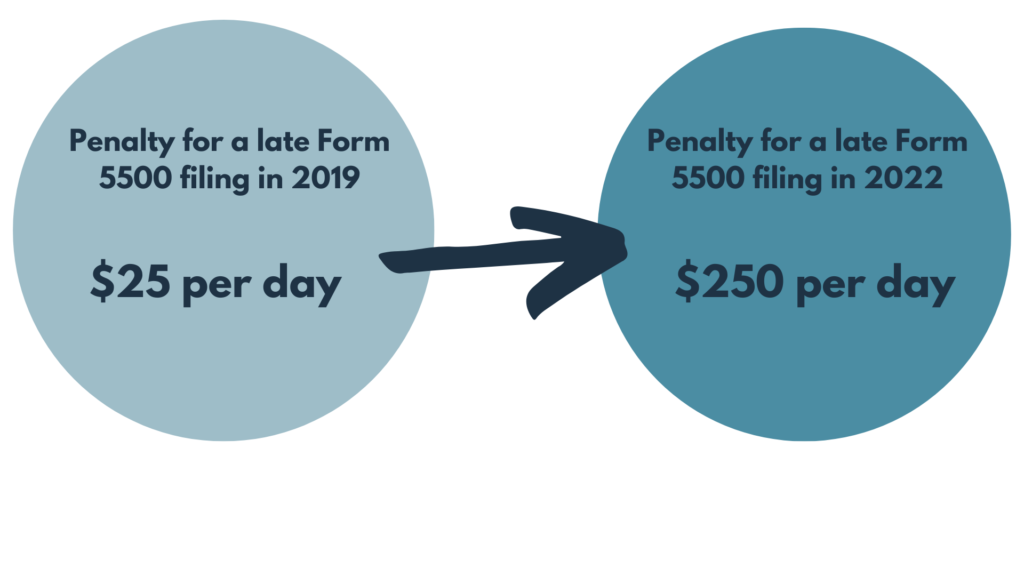

Plan sponsors should be aware that these penalties have been increased dramatically in recent years! For example, a late 5500 filing will result in a penalty of $250 per day. A few years ago, in 2019 that same penalty was $25 per day. Not meeting IRS deadlines and regulations will be an even more costly mistake going forward.

A great solution is hiring a Third-Party Administrator (TPA) to alleviate the administrative burdens that come along with retirement plan administration.

What to consider when hiring a TPA? Not all TPA’s offer the same levels of service. Here at ADMIN Partners, you can guarantee a level of service that will give you a peace of mind knowing your plan is established and maintained in a compliant manner.

ADMIN Partners is a full service TPA. We offer step by step guidance from the beginning of implementation, walking our clients through all the provisions that are available to their plan. We are here to answer day to day questions and concerns that may arise after implementation. Our services can also include comprehensive compliance sign offs which ensure any compliance request a participant makes is compliant within the provisions of the established plan. Common remittance of contributions is also available to our plans. Our in house plan administrators handle all year end services for our plans that are subject to ERISA. The available services include: form 5500 filing, filing of SSA-8955, nondiscrimination testing, and additional schedules if applicable. We offer a variety of services to better suit your plan and needs. If you would like to learn more about us, click the link below!

The increased penalties have the potential to have a huge impact on plan sponsors making it even more important to have a complaint plan and follow IRS guidelines and regulations. ADMIN Partners can help you with that. If you feel your retirement plan is out of compliance, please feel free to contact us for a free plan consultation. Please reach out to us at contact@youradminpartners.com for more information on how we can help your plan.