This week in our (b)informed series we are tackling the subject of self-correction. Making sure your plan documents are up-to date and compliant is extremely important. If the plans are not, self-correction can be a vital tool to remedy that for plan sponsors. The deadline to do so, is nearing this December 2022.

ADMIN Partners believes there are literally thousands of 403(b) Plan Sponsors who have not adopted a pre-approved 403(b) plan document (not to mention those that never adopted a written plan). So, the question is – what can these Plan Sponsors do to get the advantages of using a pre-approved plan document? If you are interested in learning more about IRS audits and the benefits of a pre approved plan document, join us September 28 at 2:00pm (EST) for an informative webinar on the topic. Register below!

What is Self Correction?

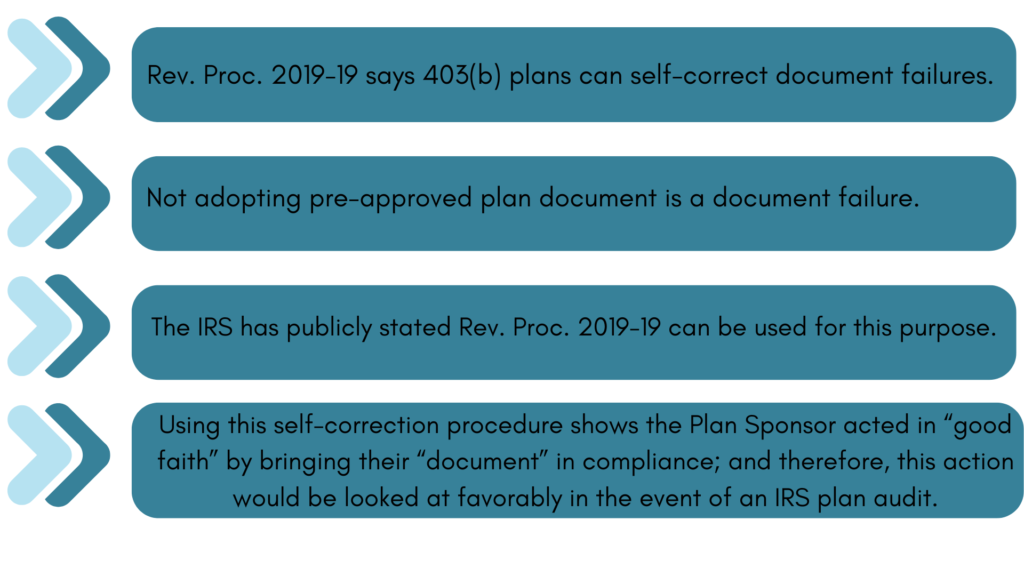

As per the IRS, “The IRS Employee Plans Compliance Resolution System (EPCRS) permits any size business or organization that sponsors a retirement plan (including SEP and SIMPLE IRA plans) to identify and correct many failures they find.” In 2019, the IRS issued Revenue Procedure 2019-19 (Rev. Proc. 2019-19). This Revenue Procedure sets out provisions of the IRS’s Employee Plans Compliance Resolution System (EPCRS) and permits 403(b) plans to be “self-corrected” (that is, amending a plan document without obtaining formal IRS approval of the amendments).

To continue, under the Revenue Procedure guidance, the ability to self-correct 403(b) plans to a pre-approved version is available through December 31, 2022. Even though the ARA has asked the IRS to “put it in writing,” and explicitly say that Rev. Proc. 2019-19 can be used for this purpose. To date, the IRS has not responded to this request. Nonetheless, ADMIN Partners has decided not to wait on the IRS. After consulting with legal counsel, we believe the risk is negligible to utilize the Rev. Proc. to “self-correct” 403(b) plan documents. The facts are:

If you are not sure if your plan documents are up to date, reach out to our team! Please feel free to contact a member of our team at (877) 484-4400 Option 2 or [email protected] and on all social media platforms @adminpartners.